ALERT – CORPORATE COMPLIANCE

HOW CRIMINAL COMPLIANCE IS REGULATED IN PERU? CLARIFICATIONS ABOUT COMPLIANCE REGULATORY SYSTEMS

In respect to criminal compliance systems—compliance programs provided for by the Peruvian regulation in order that companies would prevent the commission of crimes in or through their organization—it is necessary to distinguish two scopes that, although there are similarities, they have their own particularities:

- Prevention Model pursuant to Act No. 30424 (amended by Legislative Order No. 1352 and Act No. 30835)

- The design and implementation of a prevention model is not mandatory as per regulations, and non-implementation does not mean itself any sanction to the company.

- However, in the event that any of the company’s directors, attorneys-in-fact, representatives or employees commit any crime set forth by law (i.e. bribery to public or foreign officers, collusion, influence peddling, money laundering and terrorism financing) on behalf of the company and its benefit, an investigation could be initiated and the company may be sanctioned pursuant to law.

- The investigation against the company will be conducted by the Prosecutor, but before filing concrete charges against it (by filing a well-grounded criminal complaint), the Prosecutor shall gather a Superintendency of Security Market (SMV) technical report on effective implementation and functioning of the company’s prevention model.

- If SMV conclusion is that there is no model or it does not comply with the requirements pursuant to law, the Prosecutor will initiate a criminal proceeding against the company. Sanctions against the company shall be imposed by a Criminal Court.

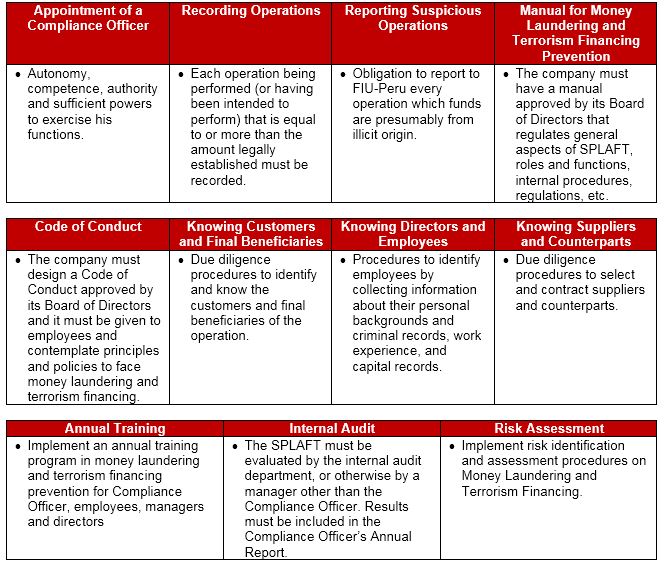

- As per law, table below shows the requirements that, as minimum, must be considered for a prevention model, as well as basic activities that are being considered to be executed for its duly implementation:

Unlike the prevention model pursuant to Act No. 30424, the Money Laundering and Terrorism Financing Prevention System (SPLAFT) is mandatory as per regulations, and if the company legally liable to implementation (‘Liable Party’) does not comply therewith, it will be imposed an administrative sanction through penalties.

- The Superintendency of Banking, Insurance and Private Pension Fund Management Company (SBS), through its Financial Intelligence Unit (FIU), is the public agency in charge of general supervision of anti-money laundering regulation compliance. Due to the wide diversity of Liable Party, for the compliance of this duty, the UIF supports on other supervisor entities defined by law in accordance with its functions (e.g. SBS supervises banks; National Superintendency of Customs and Tax Administration (SUNAT) supervises customs agents; licensed professional associations supervise their members; SMV supervises brokerage firms, etc.)

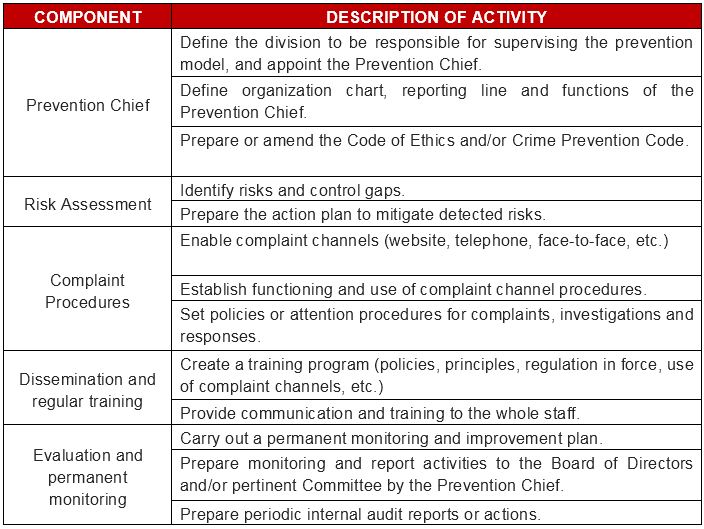

- Main SPLAFT requirements Liable Party must implement are as follows: