Partial electronic audit procedure.- Through Superintendence Resolution No. 124-2020/SUNAT, published on July 27, 2020, Superintendence Resolution No. 303-2016/SUNAT is amended for the purpose of submitting observations to the preliminary settlement and support of said observations in the Electronic Partial Audit Procedure for Internal Taxes.

To this end, from November 2, 2020, an environment shall be enabled in the SUNAT Online Operations system so that auditees may present and support their observations on the preliminary settlement made by SUNAT.

Financial reporting for automatic exchange of information.- Through Superintendence Resolution No. 120-2020/SUNAT, published on July 19, 2020, new maximum dates have been established to present:

i. The informative affidavit referred to in Superintendence Resolution No. 270-2019/SUNAT, containing the financial information for the year 2019; and,

ii. The Financial Report – ECR statement for the year 2018, regarding the pre-existing accounts of high value of natural persons. Thus, both statements must be submitted to SUNAT according to the following schedule:

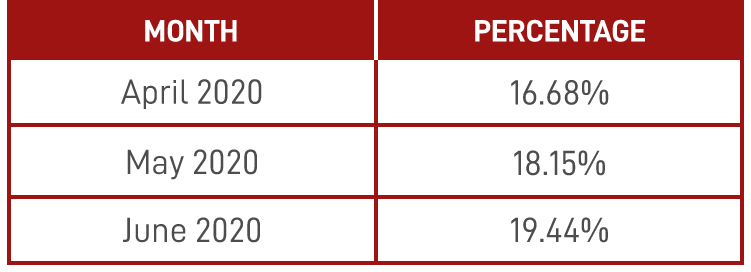

Refund of Selective Consumption Tax (ISC) for carriers that provide ground transportation service.- Within the framework of Emergency Decree No. 012-2019 and its Regulations, Superintendence Resolution No. 117-2020/SUNAT, published on July 16, 2020, has adopted the percentages to determine the maximum refund limit of the ISC for the above-mentioned carriers, said percentages being the following:

Electronic notification of acts of the Tax Court.- Through Ministerial Resolution No.205-2020-EF/40, published on July 17, 2020, a new “Procedure for electronic notification of administrative acts issued by the Tax Court and other acts facilitating the resolution of disputes” is adopted and the range of subjects who are required to join the electronic notification system is expanded.

This, among others, provides that, from July 29, 2020, all taxpayers with files pending resolution in the Tax Court shall be required to join the electronic notification system.

Also, from Monday, July 20, 2020, taxpayers with an electronic mailbox shall receive all their notifications by this means, even if they expressly requested that the acts related to old files be notified by physical means.

Provisions for the new Deferral and/or Fractionation Regime (RAF) of tax debts administered by SUNAT.- Through Superintendence Resolution No. 113-2020 / SUNAT, published on July 4, 2020, the regulations for the submission of the application for placement with the RAF, its withdrawal, the characteristics of the guarantees, among others, are adopted. The following are some of the most relevant aspects:

i) The request for placement must be made using Virtual Form No. 1704. The deadline for submitting this request began on July 8 and ends on September 30, 2020.

ii) You must log in to SUNAT Online Operations and go to the option “Request RAF Fractionation” to access the form. In this section, the debts and amounts that shall be the subject of fractionation must be identified, indicating the type and number of the associated document.

iii) If the taxpayer guarantees the debt with a letter of guarantee, it must be delivered at any SUNAT taxpayer service center, within fifteen (15) working days following the date of submission of the request for placement. If the debt with mortgage is guaranteed, its formalization must take place with the registration within a period of thirty-five (35) working days from the day following the date of submission of the request for placement.

Obligation of trusts or trust properties to inform the final beneficiaries.- In relation to this obligation, regulated in Legislative Decree No. 1372 (DL 1372) and its Regulations, SUNAT, through Report No. 042-2020-SUNAT/7T0000, pronounces on the scope of the same, in the following terms:

i) For the purposes of the statement of final beneficiary to be submitted by legal entities (trusts or trust properties) to SUNAT, the provisions of the Second Final Complementary Provision of DL 1372 do not apply (concerning the definition of the final beneficiary and the due diligence procedure that financial institutions must apply for the purposes of the automatic exchange of information as agreed in the International Treaties and Commission Decisions of the Andean Community).

ii) If the trustee is a company of the local financial system, it shall be responsible for providing the information of the final beneficiaries of the trust as a legal entity. In this case, the trustee is not exempted from providing such information when it refers to companies and issuers of securities registered in the Public Registry of the Stock Market.

iii) The procedure established in literal d) of numeral 7.1 of article 7 of the Regulation (to validate the information provided by the final beneficiary) is applicable to legal entities. This, although in accordance with the provisions of article 179 of the General Law on the Financial System and the Insurance System and Organic Law of the Superintendence of Banking and Insurance, all information provided by the client to a company of the financial system or in the insurance system has the character of an affidavit.

iv) In the case of legal entities, trusts or trust properties, where the trustee is a company of the local financial system, the obligation to update the information of the final beneficiary is carried out not only on the basis of the prior communication that, for that purpose, refer the final beneficiary to the trustee, but they must validate the information provided by the final beneficiaries supporting that condition, as well as file and keep the supporting documentation; as in the case of changes in the status of final beneficiaries.

Claim submitted by the Virtual Table of Parts (MPV-SUNAT).- Report No. 050-2020-SUNAT/7T0000 SUNAT confirms that the claim appeal filed through the MPV-SUNAT has the same legal validity and effectiveness than that submitted by physical means.

Depreciation of property acquired through a financial lease and whose construction is in stages.- Report No. 036-2020-SUNAT/7T0000 analyzes the assumption of a shopping center acquired through a financial lease, which is built in stages and whose final facilities are in the process of being implemented, whereas some of the premises have already been handed over to the lessee and the latter obtained the right to use them. These premises do not constitute separate real estate units and are given for use by the lessee to third parties in exchange for a consideration that is received before the completion of the operations of the facilities. Regarding the depreciation of the premises that make up the aforementioned property, SUNAT states the following:

i) Depreciation of the premises given for use to third parties must start from the month following the month in which the transfer took place.

ii) Once the construction of each stage has been completed, and at least one premises corresponding to said stage have been given for use, the depreciation shall begin for each premises given for use to third parties, from the month following the one in which the transfers took place.

iii) The basis on which the referred depreciation must be applied is only the portion of the financed capital corresponding to the premises given for use to third parties, in the condition in which they are transferred.

iv) In the event that the aforementioned shopping center is acquired or built with its own capital:

Land that has an urban authorization resolution – Alienation.- Through Report No. 026-2020-SUNAT/7T0000 it is stated that in the case of a natural person without a business that is not usual in the alienation of real estate, who, in a single act and to a single acquirer, alienates all of its shares and rights (ideal quota) that it has on a land that has an urban authorization resolution according to Law No. 29090, of which both seller and buyer are co-owners; the income obtained from said alienation is subject to income tax as income product; that is, as business income and not as capital gain.

Rectification that determines a lower tax obligation and that was submitted during the State of Emergency.- Report No. 040-2020-SUNAT/7T0000 establishes that the term of 45 working days established by numeral 88.2 of article 88 of the Tax Code for the Tax Administration to issue a pronouncement on the veracity and accuracy of the data contained in a rectifying affidavit that determines a lower tax liability, it was suspended by the effect of Emergency Decree No. 029-2020 and expansion regulations.

Suspension of prescription during the State of Emergency.- Through Report No. 039-2020-SUNAT/7T0000, SUNAT concludes that the declaration of a State of National Emergency and the mandatory social isolation (quarantine) provided by the National Government through the Supreme Decree No. 044-2020-PCM and expansion and amendment regulations:

i) Suspends the limitation for the action of the Tax Administration to determine the tax liability and apply sanctions, from March 16, 2020 and for as long as said measure prevents it from exercising said action, which must be determined in each specific situation.

ii) Suspends the limitation period for the action to request or effect compensation, as well as to request a refund, from March 16, 2020, during the period in which such measure prevents the Tax Administration from exercising its activities related to such actions, as is the case, of the receipt of requests for refund or compensation from taxpayers, which must be determined in each specific situation.

Police report does not qualify as strong evidence.- Through Tax Court Resolution No. 02708-8-2020, the following mandatory compliance criteria are established:

“The police report for loss or misplacement of documents submitted after the beginning of the audit does not constitute strong evidence to prove such fact. Therefore, said complaint does not justify the failure of the auditees to submit and/or display the documentation required in the audit”.

Result of the request that did not record the closing date – Nullity.- In Resolution No. 05859-8-2019 the Tax Court establishes that the failure to record the closing date in the result of the request, violates the provisions of articles 2 and 8 of the Regulation of the Audit Procedure. Based on this, it declared the result of the request and the related documents null and void.

Loan – Alleged interest vs. transfer pricing rule (RTF No. 02547-9-2019).- In the SUNAT case had repaired a loan operation by applying alleged interest based on the rule provided in the first paragraph of article 26 of the Income Tax Act. The taxpayer (lender) argued that, having this and the borrower a director and manager in common, they qualified as related parties for tax purposes, the rule invoked by SUNAT not being applicable, but rather the one provided in the last paragraph of the aforementioned article, by virtue of which, in the case of loans between related parties, the aforementioned allegation does not operate but, transfer pricing rules.

The Tax Court concluded that the taxpayer did not properly prove the economic relationship with the borrower since, in order for it to be configured based on the allegation set forth in paragraph 5 of article 24 of the LIR Regulations, the directors or managers are required to have decision-making power in financial, operational and/or commercial agreements, which was not accredited by the taxpayer, not being enough the simple verification of the information that appears in the RUC Consultation of the SUNAT website from which it flows that both companies had a director and manager in common.