Investigation procedure for dumping practices on imports of steel bars originating in Brazil and Mexico, without imposing definitive anti-dumping duties, is terminated.- On May 1, 2019, Resolution No. 062-2019/CBD-INDECOPI was published, by virtue of which the Commission on Dumping, Subsidies and the Elimination of Non-Tariff Trade Barriers of this entity decided to terminate, without the imposition of definitive anti-dumping duties, the investigation procedure for dumping practices on imports of certain corrugated steel bars, in straight length or in rolls, with nominal diameters of 3/8”, 5/8”, 3/4”, 1/2”, 1”, 1 3/8”, 6 mm, 8 mm and 12 mm1, originating in the Federative Republic of Brazil and the United Mexican States. The reason why no anti-dumping duties were imposed is the fact that, during the period evaluated (From January 2014 to September 2017), the Domestic Industry experienced a positive development in most of its economic indicators (production, domestic sales, market share and profit margin), and it is therefore concluded that the alleged threat of injury alleged by the Domestic Industry is not foreseeable or imminent. It should be noted that this procedure was initiated by said Commission through Resolution No. 213-2017/CBD-INDECOPI, published in the Official Gazette El Peruano, on November 2, 2017, as a result of the request made by the Domestic Industry.

Discretionary power to not determine or sanction infractions provided for in the General Customs Law is approved.

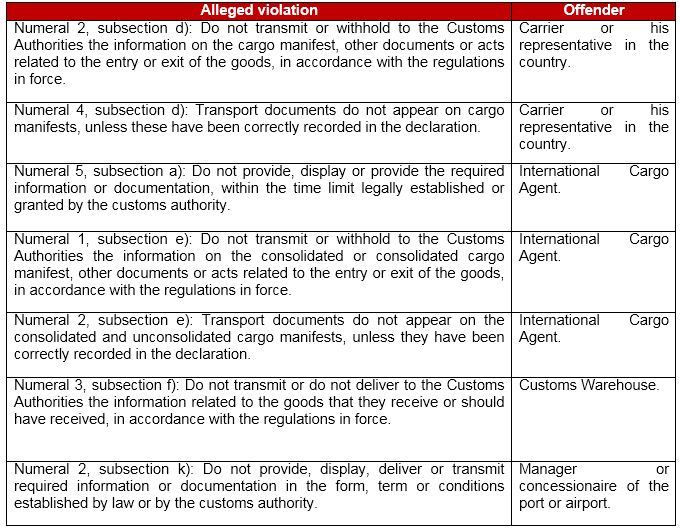

On May 4, 2019, the Resolution of the Deputy Superintendency of Customs Office No. 006-2019/SUNAT/300000 was published, which authorized the exercise of discretionary power to not determine or sanction certain infractions committed by carriers or their representative in the country, international freight forwarders, customs warehouses and port and airport administrators or concessionaires, linked to the obligation to transmit or deliver to the Customs Administration information on the cargo manifest, as well as other documents and information related to the entry of goods and means of transport. The infractions provided for in article 192 of the General Customs Act which may be the subject of such discretion are the following:

For the purposes of the application of said discretionary power, the standard that is the subject of comment is required and the following conditions must be met: a) The cargo has arrived by sea, air or river; b) The infraction has been committed: b.1) by sea or river: from 05/06/2019 to 08/06/2019. b.2) by air: from 06/03/2019 to 09/03/2019. c) The offender must transmit or record the omitted information. d) The infraction typified in numeral 2) of Subsection k) of Article 192 of the General Customs Act must result from the breach of an obligation provided for in the general procedure “Cargo Manifesto” DESPA-PG.09 (version 6). This measure is based on the fact that inconsistencies that configure the aforementioned infringements could occur, as long as the implementation, between the months of May and June 2019, of the improvements related to the process of entry of goods to the country within the framework of the component project “Entry Processes” of the “Customs Facilitation, Security and Transparency” Program – FAST.

Delegate powers and sign a Trade Agreement between the United Kingdom of Great Britain and Northern Ireland, on the one hand, and the Republics of Colombia, Ecuador and Peru, on the other. – The Supreme Resolution No. 086-2019-RE, sufficient powers were delegated so that the Minister of Foreign Trade and Tourism can sign the Trade Agreement between the United Kingdom of Great Britain and Northern Ireland, on the one hand, and the Republic of Colombia, the Republic of Ecuador and the Republic of Peru, on the other. According to press reports, this Trade Agreement was signed on May 15, 2019, which seeks to ratify and preserve the tariff preferences obtained between the subscribing countries, taking into account the eventual departure of the United Kingdom from the European Union.

Amendments to the Consolidated Text of Administrative Procedures of the SUNAT are approved.- On May 18, 2019, the Superintendency Resolution No. 104-2019/SUNAT was published, through which amendments have been made to the TUPA of SUNAT. The following amendments to Administrative Procedures are highlighted: «Import for consumption whose FOB value is greater than US$2,000.00», «Definitive importation of unaccompanied luggage», «Reception to the Law of Economic and Social Reinsertion for Returned Migrants», «Definitive export with FOB value greater than US$5,000.00”,“Temporary admission for re-export in the same State ”and“ Temporary admission for Inward Processing”. These amendments are based on the provisions of Legislative Decree No. 1246, pursuant to which various administrative simplification measures were approved, including the prohibition of requiring the person adversely affected, requirements or information contained in records of free access via the internet or other means of public communication to which public entities can access. In addition, the Superintendency Resolution above mentioned has provided for the elimination of, among others, the procedures for «Challenge of the Resolution declaring the abandonment of confiscated property» and «Challenge of the Resolution declaring the abandonment of vehicles (subject to temporary internment)».

General procedure «Material for aeronautical use» DESPA-PG.19 is amended. On May 31, 2019, the Superintendency Resolution No. 119-2019/SUNAT was published, through which amendments were made to the General Procedure “Material for Aeronautical Use” DESPA-PG.19 (version 2). These amendments are fundamentally linked to the implementation of the Customs Facilitation, Security and Transparency Program (FAST), which will generate the optimization of the processes through the use of the Customs Clearance System (SDA) platform, allowing the use of boxes and electronic forms for procedures related to the entry, transfer, permanence and exit of the goods destined to the special customs regime for aeronautical equipment.

Recommendations related to questions from the Customs Administration regarding tariff classification.- On the occasion of the recurring legal advice that we provide to various clients, we have noticed the special emphasis that the Customs Authorities have been putting on the correct tariff classification of the goods and it is not uncommon for this authority to raise questions regarding this issue. Such questions could have an impact on the determination of higher taxes and application of fines, calculation of the ceiling for obtaining the annual benefit of Drawback, application of anti-dumping duties or similar rights, as well as the determination of origin of goods and even the determination of goods as prohibited or restricted, to give some examples. In view of the above, we suggest being duly prepared to properly accredit and within the time limits granted by the Customs Authorities (whether during import or export clearance or in control procedures), the tariff classification assigned to the goods subject to foreign trade operations for which an adequate technical-legal analysis of the Customs Tariff and its related interpretation aids will be required, as well as technical supporting reports to enable the characteristics of the product concerned to be clearly identified.