Amendment of the Regulations establishing the financial information to be provided to SUNAT.- Through Supreme Decree No. 009-2021-EF, published on January 26, 2021, Supreme Decree No. 430-2020-EF is amended in order to establish the following provisions:

(i) Financial system companies must provide information to SUNAT when the balance in bank accounts is equal to or greater than S/.30,800.00 (thirty thousand eight hundred soles) in 2021. The previous limit was S/.10,000.00 (ten thousand soles).

ii) The period to be reported is monthly, but the submission of the tax return shall be semi-annual, according to the calendar published by SUNAT.

iii) It is specified that the information obtained by SUNAT shall be treated under the rules of confidentiality and computer security required by the international standards and recommendations regarding the automatic exchange of financial information of the OECD.

New version of the PDT Electronic Return – PLAME, Virtual Form No. 0601 is adopted.- Superintendence Resolution No. 233-2020/SUNAT, published on January 6, 2021, adopts version 3.8 of PDT Electronic Return – PLAME, which has been mandatory since January 7, 2021.

There is a discretionary power not to sanction.- With the Resolution of the National Deputy Superintendence No. 001-2021-SUNAT/700000, published on January 7, 2021, it is decided to apply the discretionary power not to sanction administratively:

i) Infringements typified in the paragraph 1 of Article 174 (not issuing payment vouchers) and paragraphs 1 and 7 of Article 177 (related to obligations on accounting books and records) of the Tax Code, incurred until March 15, 2020.

ii) Infringement typified in paragraph 5 of Article 177 of the Tax Code (failure to provide required information), in which the taxpayers belonging to the New RUS had incurred until March 15, 2020.

It is also specified that payments related to infringements of discretion shall not be refunded or compensated.

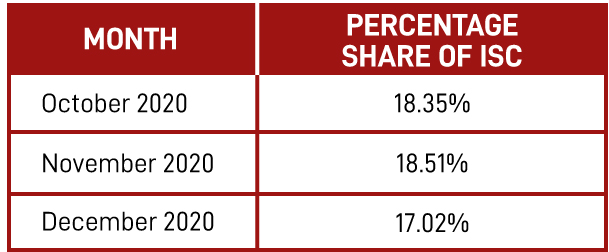

Percentages are established to determine the maximum refund limit of the Selective Consumption Tax (ISC) for carriers.- Superintendence Resolution No. 004-2021/SUNAT, published on January 17, 2021) adopts the percentages required to determine the maximum refund limit of the ISC for carriers that provide land transportation services.

COVID 19: Status of domicile.- Report No. 133-2020-SUNAT/7T0000 states that the measure of total border closure provided for in Supreme Decree No. 044-2020-PCM does not suspend the term provided for in Article 7 of the Income Tax Law to establish the status of domicile in Peru.

Details on the tax return of final beneficiaries.- Report No. 129-2020-SUNAT/7T0000 specifies certain provisions of Legislative Decree No. 1372 and its Regulations:

(i) In the case of a legal entity whose shares are traded through a foreign stock exchange that are acquired by an investment vehicle (legal entity) whose beneficiaries are natural persons, it is up to the legal entity to request from its partner or shareholder (legal entity abroad) the information of its beneficial beneficiaries; even if such legal entities may be listed on a stock exchange or if the shares are acquired by legal entities (investment vehicles).

ii) The copy of the articles of incorporation of the non-domiciled legal entity that would certify that the shares are to the bearer is an example of the type of document that would support the steps or due diligence that must be exhausted to identify the final beneficiary.

Iii) The format referred to in subsection a) of paragraph 7.1 of Article 7 of the Regulations of Legislative Decree No. 1372 is a suggested model and, therefore, may be modified according to the needs of each taxpayer, as long as it contains all the data that allow the full identification of the final beneficiary.

Reasonable period of time in administrative headquarters (Judgment in Case No. 02051-2016-PA/TC).- In this judgment, the Constitutional Court laid down several criteria related to the legal time-limit for resolving contentious proceedings concerning nullity:

(i) The suspension of the computation of the statute of limitations period provided in the original wording of the penultimate paragraph of Article 46 of the Tax Code is not applicable if the Tax Court exceeds the legal term provided to decide an appeal whose contentious matter consisted of analyzing a nullity.

This is because administrative nullity is an act that strictly concerns the adjudicating bodies; therefore, it is not reasonable that the taxpayer assumes the negative effects caused by the excessive delay in resolving it.

ii) It is unconstitutional to charge default interest during the period in which the administrative authority exceeds the legal term to decide claims and appeals for causes attributable to it.

iii) In order to determine whether there was a violation of the right to a reasonable term to decide the claim and appeal, in the specific case, the Constitutional Court established that: a) the matter was not complex since it was clearly delimited; b) the taxpayer did not take any action to prolong the proceedings and did not submit a large amount of documentation; c) the Tax Court took more than 4 years to decide, an excessive term; and d) the economic effects of this delay seriously affected the taxpayer, since the debt tripled.

iv) Finally, it is pointed out that these criteria are not applicable to concluded contentious proceedings or judicial proceedings (administrative litigation or constitutional proceedings) that, prior to the publication of the judgment, have a final court decision on the calculation of default interest.

It does apply in cases in which, after the publication of the judgment, they are still in process or pending final resolution.

Payment of the deduction for the use of the tax credit (Cassation 12873-2016 Lima).- This case analyzes the use of the tax credit corresponding to invoices recorded in the Purchase Register of September 2004 and whose deduction was deposited in December 2004. The taxpayer used the tax credit in September 2004 and both SUNAT and the Tax Court claimed that the provisions of the First Final Provision of Legislative Decree No. 940 were not complied with and that the credit must have been used since December.

In this regard, the Permanent Constitutional and Social Law Division of the Supreme Court provides for the cancellation of the deduction after the fiscal year of the tax credit does not entail the loss of the right or the fiscal year of the tax credit; whereas the obligation to deposit the deduction prior to the fiscal year is a legal requirement and an obligation imposed on the taxpayer, its non-compliance may only give rise to the penalties provided for in the legal system, not the loss of the right to the tax credit or the right to its fiscal year, since it is not regulated as a legal consequence in case of non-compliance with the amending legislation, rather, the fiscal year of the tax credit is conditional on compliance with the aforementioned requirements.

Compensation of the balance in favor of Income Tax (RTF No. 4953-2-2020).- The Tax Court establishes that it is appropriate to offset the balance in favor of Income Tax with the debt for the General Sales Tax (IGV) of another period, even when the taxpayer has chosen to offset such balance with the payments on account of Income Tax in its Annual Affidavit.

The adjudicating body asserts that there is no prohibition for the Administration, at the request of a party