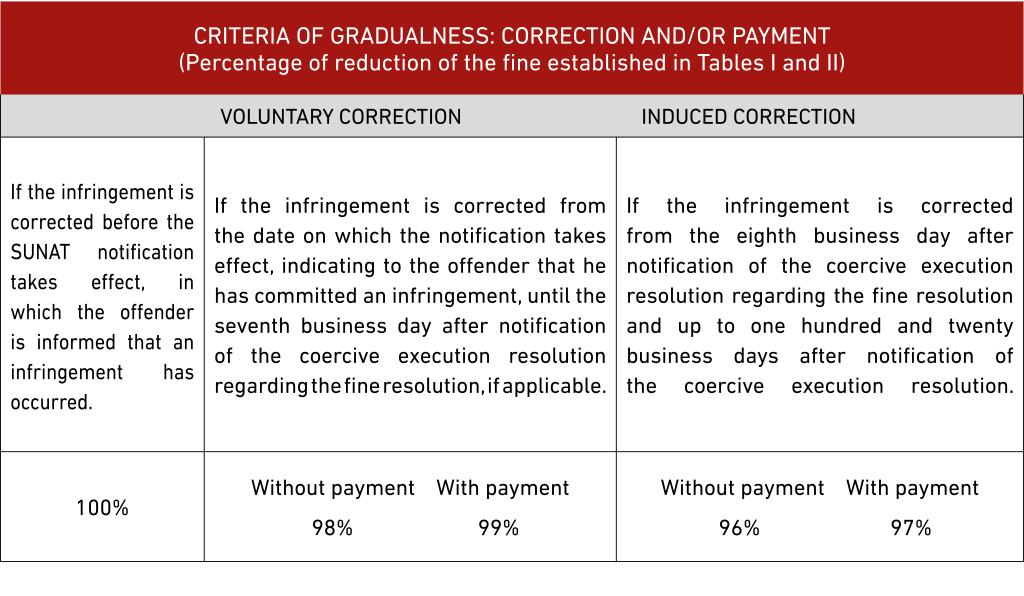

Modification of the Penalty Gradualness Regime for failure to file tax returns.- By means of Superintendence Resolution No. 007-2025/SUNAT, published on January 14, 2025, the gradualness foreseen for the penalty of the fine for the infraction typified in numeral 1 of Article 176 of the Tax Code is modified in the following aspects:

The Selective Consumption Tax (ISC) rate applicable to remote games and remote sports betting is modified.- Supreme Decree No. 008-2025-EF, published on January 19, 2025, establishes that until June 30, 2025, the ISC rate applicable to remote games and remote sports betting will be 0.3%. As of July 1, 2025, the applicable rate on the referred activities will be 1%.

The Virtual Form for the declaration and payment of the tax on remote gaming and remote sports betting, as well as the ISC applicable on said activities, is approved by Superintendence Resolution No. 010-2025/SUNAT, published on January 21, 2025, approving Virtual Form No. 0696 – “Remote Gaming and Remote Sports Betting and ISC”, for the referred purposes. The form will be available as of February 1, 2025 in SUNAT Online Operations.

The referred norm also regulates aspects such as the declaration and payment in dollars and the compensation of undue or excess payments or perceptions.

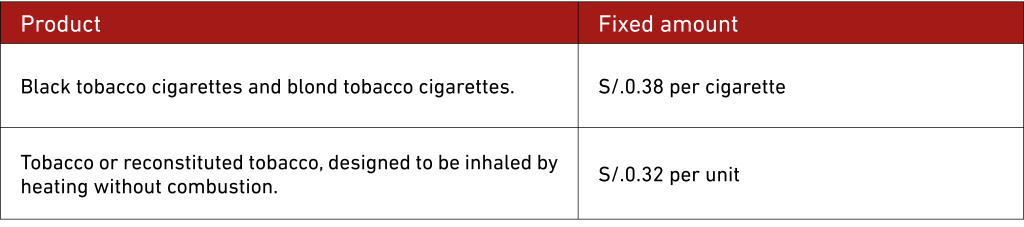

The current fixed amounts of the Specific System – Annex A for ISC are updated – Through Ministerial Resolution No. 012-2025-EF/15, published on January 18, 2025, it has been established that as from January 19, 2025, the fixed amounts for ISC applicable to the following products are updated:

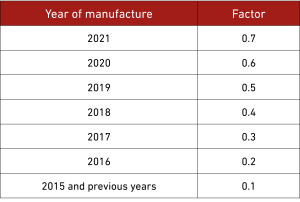

Table of Reference Values for the year 2025 for the Vehicle Wealth Tax: Through Ministerial Resolution No. 010-2025-EF/15, published on January 15, 2025, it is established that in order to determine the reference values of vehicles whose year of manufacture is prior to 2022, the value of the vehicle indicated for the year 2024 must be multiplied by the factor indicated for the year to which its manufacture corresponds, according to the following detail:

Additionally, it is specified that the determined value must be rounded to the higher ten soles, if the number of units is S/ 5.00 (five soles) or more, or to the lower ten soles, if the number of units is less than S/ 5.00 (five soles).

New version of the PDT Electronic Spreadsheet- PLAME, Virtual Form Nº 0601 is approved.- By means of Superintendence Resolution N° 015-2025/SUNAT, published on January 31, 2025, version 4.4 of the PDT Electronic Spreadsheet – PLAME is approved, to be used as from January 2025.

The new version of Virtual Form 615 (ISC) is approved.- Through Superintendence Resolution N° 016-2025/SUNAT, published on January 31, 2025, version 5.7 of the ISC PDT – Virtual Form N° 615 has been approved and must be used as from February 1, 2025, regardless of the period to which the return corresponds, even for substitute or rectifying returns.

Discretionary power not to sanction infractions related to the use of the Integrated System of Electronic Records (SIRE).- By means of Resolution of the National Deputy Superintendence of Internal Taxes No. 00003-2025-SUNAT/700000, published on January 31, 2025, it has been decided to apply the discretionary power not to administratively sanction the infractions typified in numbers 2 and 10 of Article 175 of the Tax Code, to those taxpayers who:

Application of IAS 16 “Property, Plant and Equipment” to fixed assets.- According to Report No. 001-2025-SUNAT/7T0000, in the event that, by application of accounting standards, a company has distributed the amount initially recognized as fixed assets among its significant parties, for tax purposes, the initial cost, depreciation and subsequent cost of the fixed assets are determined for each fixed asset in its entirety for the calculation of income tax:

Extension of the special installment payment under Legislative Decree No. 1634.- Report No. 004-2025-SUNAT/7T0000 states that the extension of the special installment payment under Legislative Decree No. 1634, provided for by Law No. 32220, applies to all payment modalities contemplated in said legislative decree: cash, summary and installments.

Fine for obtaining a refund of an unduly declared credit balance.- By means of Report No. 008-2025-SUNAT/7T0000, SUNAT states that when a refund of an unduly declared credit balance is obtained, the applicable fine must be calculated by adding 50% of the omitted tax payable and 100% of the unduly refunded amount.

Assumptions of nullity of requirements issued by the Tax Administration (Cassation No. 12141-2024, Lima).- The Fifth Chamber of the Supreme Court concludes in this decision that the requirements of the Tax Administration requesting additional information or documentation in an audit procedure are null and void when: i) they are issued after the expiration of the 12-month term established in Article 62-A of the Tax Code for the definitive audit: or, ii) they are issued under Article 75 of the same legal text after the expiration of the aforementioned audit term.

The Chamber develops its position by pointing out that in accordance with Article 75 of the Tax Code, two moments are distinguished: the first is the period of time that the audit lasts (12 months), after which the corresponding securities can be issued; and the second is the period between the conclusion of the audit and the effective issuance of the securities. He adds that, once the audit is concluded, the Administration can only communicate its conclusions, indicating the observations made, without the possibility of requesting additional information or documentation.

Thus, based on a systematic interpretation with Article 62-A of the referred code, the Chamber points out that, once the audit period has expired, it is not admissible to request additional information from the taxpayer to that requested within said period. This is due to the fact that Article 75 only authorizes the issuance of a requirement to communicate the conclusions and other aspects, without allowing new requests for information.

Substantiation for inventory adjustment due to differences in the physical inventory caused by shrinkage (RTF No. 06922-1-2024).- The taxpayer supported the referred adjustment in monthly technical reports and in a study of shrinkage prepared in a fiscal year subsequent to the fiscal year audited, and also supported the causes that gave rise to the shrinkage and that these were related to its ordinary activities. SUNAT argued that the fact that the shrinkage study was from a different fiscal year disqualified the taxpayer’s support and did not evaluate the reports or other evidence.

The Tax Court upheld the taxpayer’s position and stated that although it would be appropriate for the technical report to be prepared in the same year in which the events that caused the losses occurred, the Income Tax regulations do not condition the deductibility of such concept to the timeliness of the preparation of such report, so that it could be prepared even after the year in which the losses occurred. Therefore, after verifying that SUNAT did not evaluate the evidence, the ruling body considered that the objection was not duly supported and declared it null and void.