A special tax regime is created to promote tourism.- Law No. 32392, the New General Tourism Law, published on June 27, 2025, creates Special Tourism Development Zones (ZEDTs). These are delimited geographic areas established by the National Government. These areas will have special conditions and incentives, differentiated from the rest of the national territory, designed to simplify and improve the framework applicable to private investment in tourism and encourage formalization.

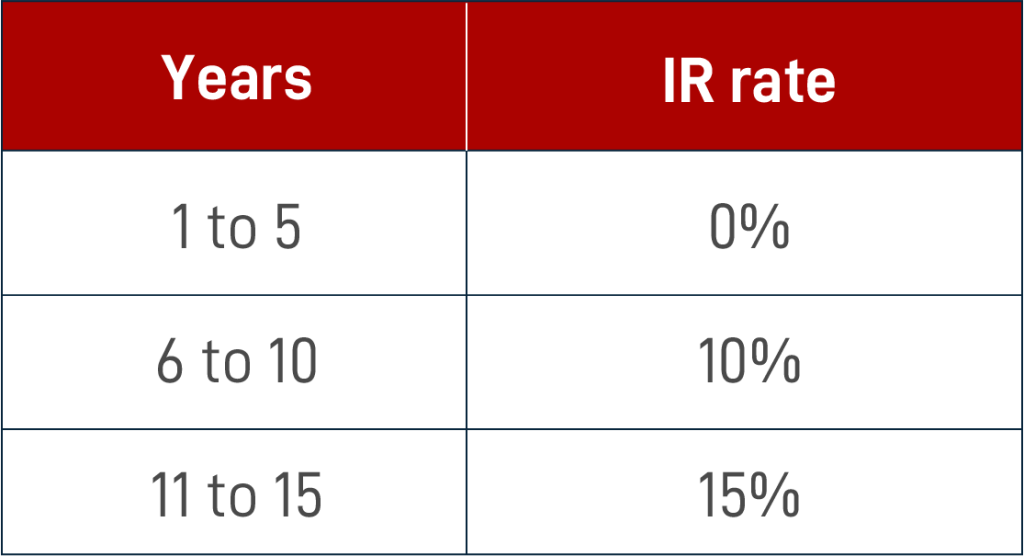

Thus, tourism activities and services carried out by ZEDT users within these geographic areas will benefit from a reduced third-category income tax rate:

To access this benefit, ZEDT users registered with the RUC must:

For the purposes of applying Income Tax benefits, any new entity incorporated or established in the country (a national legal entity or a branch or permanent establishment of a foreign entity) as of the entry into force of Law No. 32392 and authorized by MINCETUR (Ministry of Tourism and Tourism of the Dominican Republic). Exceptionally, a pre-existing legal entity may establish a new legal entity to become a user, provided it has not previously carried out the same activities.

Finally, this regime will have a maximum duration of 15 years and will be subject to technical evaluation after 3 years.

In addition, other incentives have been established to promote tourism development and business growth outside the ZEDT. The main ones are the following:

The use of the Integrated Electronic Records System is postponed. – On June 26, 2025, Superintendency Resolution No. 000217-2025/SUNAT was published, which aims to postpone from July 2025 to January 2026 the period from which major taxpayers must maintain the Sales and Income Registry and the Purchase Registry through the SIRE.

Discretionary power not to sanction violations related to the issuance of Electronic Remittance Guides (ERG).- Through Resolution No. 000026-2025-SUNAT/700000 of the National Deputy Superintendency of Internal Revenue, published on June 26, 2025, the Office of the Comptroller General of Internal Revenue (SUNAT) stipulates that the violations classified in sections 5 and 9 of Article 174 of the Tax Code, detected from July 1, 2025, to June 30, 2026, related to the issuance of ERGs and EGRs in printed formats or imported by an authorized printer, will not be sanctioned.

Modification of the General Sales Tax (IGV) and Municipal Promotion Tax (IPM) rates.– Law No. 32387, published on June 16, 2025, establishes an increase in the IPM rate from 2% to 4% and a decrease in the IGV rate from 16% to 14%; such that the combined tax burden for both taxes (IGV+IPM) will continue to be 18%.

The procedure for submitting a letter of guarantee for untimely appeals is regulated.– Superintendency Resolution No. 224-2025/SUNAT, published on June 29, 2025, establishes the following:

Selective Consumption Tax (SCT) paid on the acquisition of goods.- Report No. 00056-2025-SUNAT/7T0000 states that the SCT paid on the acquisition of goods is considered:

1. Tax credit, when it is a credit or credit balance (recoverable) in accordance with the provisions of the General Sales Tax and SCT Law.

2. Computable cost of said goods at the time of their disposal for Income Tax purposes, in cases where it is not recoverable and whenever necessary to place the goods in a condition for disposal.

«Other» concept in credit notes.- In Report No. 000057-2025-SUNAT/7T0000, SUNAT states that:

1. When the Payment Voucher Regulations use the term «other» when mentioning the reasons for which a credit note may be issued, it is referring to situations other than cancellations, discounts, bonuses, or refunds, in which tax regulations stipulate that such a document must be issued.

2. The term «other» applies to the issuance of electronic credit notes for the reasons described in codes 3 (Correction due to error), 10 (Other concepts), and 13 (Correction or modification of outstanding debt amounts) of Annex 8 of Superintendency Resolution No. 097-2012/SUNAT.

Acceptance of the exceptional Income Tax Regime for undeclared income as of December 31, 2022, created by Law No. 32201.- Through Report No. 000075-2025-SUNAT/7T0000, it is specified that according to section d) of article 10 of Law No. 32201, undeclared taxed income generated until the 2022 tax year:

1. If, as of December 18, 2024, they were included in a duly notified assessment resolution and, as of that date, the taxpayer had not filed a claim, they may be subject to the Regime.

2. If, as of December 18, 2024, they were included in a assessment resolution in respect of which SUNAT had rejected the claim, and, as of that date, the taxpayer had not filed an appeal with the Tax Court, they may be subject to the Regime, provided that, as of December 18, 2024, the 6-month period counted from the day following notification of the resolution rejecting the claim has not expired.

Disbursements for environmental impact and feasibility studies of a mining project that qualify as exploration expenses (Cassation No. 16999-2024, Lima).- The Fifth Transitional Chamber of Constitutional and Social Law of the Supreme Court has ruled that disbursements for environmental impact and feasibility studies related to a mining project do not qualify as pre-operating expenses but rather constitute exploration and/or development expenses, since they are related to the technical feasibility and commercial viability of the project, which allows for the extraction of the mineral resource.

Both the Tax Administration and the lower courts of the Judiciary indicated that these expenses qualified as pre-operating expenses for the expansion of activities, as the studies were linked to mining units that would generate cash flows in the future, implying that the company was expanding its activities. The Superior Court added that only those expenses whose direct and strict purpose is to determine the probable existence of minerals or to make mineral exploitation viable could qualify as exploration expenses.

However, the Fifth Chamber has concluded that exploration activities are not incompatible with the possibility of conducting environmental impact and feasibility studies. Thus, exploration expenses are not restricted solely to drilling and location work, but can also include the conduct of pre-feasibility and feasibility studies.

Consequently, the objection is revoked and the deduction of these exploration expenses is allowed in the year in which they are incurred, as established in section o) of article 37 of the LIR, in accordance with the provisions of articles 8 and 74 of the General Mining Law.

Proof of the causality and purpose of financial expenses (RTF No. 00061-12-2025).- In this case, SUNAT questioned the taxpayer’s financial expenses, stating that neither the causality nor the purpose of the funds were proven. The company, for its part, presented as supporting documentation: the entry of its transactions in the Journal, bank cash receipts, checks supporting payments, transfer receipts, payment receipts and receipts, invoices and credit notes supporting collections, contracts, and an Excel spreadsheet detailing: transaction codes and dates, payment methods, transaction description, transaction number, bank, name or business name, company name, and transaction amounts.

However, the Tax Court upheld the Tax Administration’s objection, stating that the taxpayer failed to prove the purpose of the more than 32 financing options received or the causality of the expenditure, as it did not present evidence that effectively demonstrates the connection between the financial charges generated by the various financing options obtained and the acquisition of goods or services linked to the obtaining of taxable income or the maintenance of the source of production. It also stated that there is no clear traceability of the route of the funds obtained. It also noted that the documentation provided shows, among other things, that the payments were made from accounts other than those from which the financing was received and from accounts owned by another company.

The change of the Income Tax regime through a corrective declaration is not applicable (RTF No. 03488-2-2025).- The Tax Court affirms that the change from the Special Regime to the General Income Tax Regime through corrective declarations is not applicable, since said change does not operate retroactively, even more so if during the periods in which the tax debts were generated the taxpayer was validly covered by the Special Income Tax Regime.