Use of electronic means of payment.- Law No. 31057, published on October 21, has just declared the implementation of the use of electronic means of payment to facilitate, in a safe and real-time manner, the exchange of goods and the provision of services as a matter of public necessity and national interest.

The purpose of this law is to create a culture of safe and fast payment, to facilitate the lives of citizens and to avoid personal contact between suppliers and consumers, seeking to reduce the risk of transmission and/or contagion of viral diseases such as COVID-19 and others that may arise.

The use of electronic payment means through electronic money stored in electronic media refers to debit cards, credit cards, mobile transactions, Internet transactions and others available for that purpose, which are associated with a bank account whose holder is the consumer of the good and/or service.

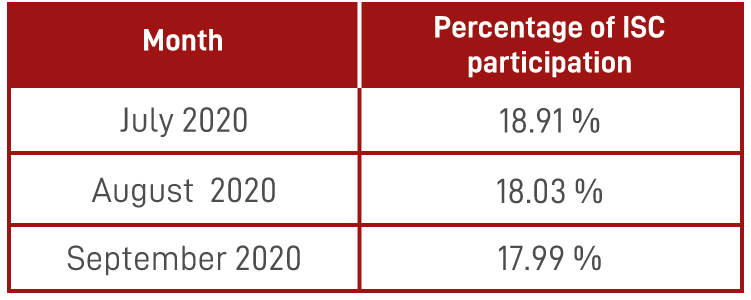

Maximum Limit of Refund of Selective Consumption Tax (ISC) for Carriers.- Through Superintendence Resolution No. 177-2020/SUNAT, in force since October 15, 2020, the percentages to determine the maximum limit of refund of the ISC for carriers providing the ground transport service have been established, referred to in Emergency Decree N° 012-2019, which regulates the procedure to determine the amount to be refunded.

Financial Information Report.- Through Report No. 078-2020-SUNAT/7T0000, SUNAT pronounces on the Financial Information Report provided for by Supreme Decree No. 256-2018-EF, regulations that establish the financial information to be provided to SUNAT in order to carry out the automatic exchange of information in accordance with the provisions of international treaties and the Decisions of the Commission of the Andean Community. In this regard, SUNAT points out that:

i) The financial entities obliged to report through the due diligence procedure, shall have to carry out the classification and maintenance of the pre-existing low-value reportable accounts of natural persons for the fiscal year 2018, within a period of 24 months, which correspond to fiscal years 2019 and 2020. The respective statement must be submitted in fiscal year 2021.

Likewise, it is specified that such obligation is not peremptory; therefore, the information related to the reported account must be examined and reported annually until the holder of the referred account loses the status of reportable.

ii) The financial institutions obliged to report that do not support the performance of due diligence procedures to back up the statement they submit to SUNAT on low-value accounts of individuals, shall incur in the infraction typified in paragraph 28 of article 177° of the Tax Code.

Depreciation or amortization of assets of a concession whose term is extended.- Report No. 073-2020-SUNAT/7T0000 refers to the assets of a concession granted under Supreme Decree No. 059-96-PCM which, for tax purposes, are depreciating or amortizing in full during the remaining period of the term of such concession. In this regard, it is established that, if such term is extended, the latter must be considered for purposes of depreciation or amortization of the balance of the depreciable or amortizable value at the date of the extension of the term.

Deduction of demolished buildings.- Report No. 070-2020-SUNAT/7T0000 refers to the case of a company that acquired a property consisting of a plot of land and a building, in order to demolish it for the purpose of building a new one and use it as a fixed asset. In this regard, it is noted that in order to determine its net income, such company must deduct the loss constituted by the part of the acquisition value attributable to the building to be demolished, in the period in which such demolition takes place.

Disposal of a permanent establishment.- In Report No. 061-2020-SUNAT/7T0000, SUNAT analyzes the effects of an international merger between two foreign companies, resident in a country with which Peru does not have a Double Taxation Convention (DTC), since the acquired company maintains a Permanent Establishment (PE) in Peru under the modality of a fixed place of business, which has tangible and intangible movable assets assigned for the development of economic activities in the country; while the acquiring company does not have a PE.

In this regard, the following conclusions may be drawn as follows:

i) The PE maintains its RUC number and must notify SUNAT of any changes that may apply for the purpose of updating its information; as long as it continues its activities and the merger involves only the change of its original parent company.

ii) For the purposes of the Income Tax Act, on the occasion of said merger:

Securitization Trusts.- Report No. 046-2020-SUNAT/7T0000 states the following:

i) In the case of a securitization trust, in which the securitization company issues securities with credit content (issuance of bonds), the individual who receives the results of such bonds as an investor has the status of trustee and, therefore, qualifies as its final beneficiary.

ii) Both securitization trusts and mutual investment funds in securities, in their condition as legal entities, are obliged to submit the information affidavit of final beneficiary identifying all their final beneficiaries, as well as to update it every time they detect that such information has changed; no exception to this obligation has been provided.

Free delivery of goods (Cassation No. 4796-2018 Lima).- The Third Chamber of Constitutional and Transitional Social Law of the Supreme Court analyzes whether the free delivery of samples, advertising material, manuals and explanatory brochures of products by the manufacturer to the intermediaries that commercialize such products, constitutes a profit or income derived from transactions with third parties for such intermediaries.

In this regard, it is stated that the nature of the goods delivered limits their commercialization since the purpose of the transfer is not to enter into the patrimonial sphere of the intermediate operator, but to transfer them free of charge to the final consumers or clients. Therefore, it is determined that the intermediary company that receives free goods of advertising content to be transferred free of charge to the final consumer or client must not recognize such goods as income tax revenue because they lack the legal condition of income.

In addition, the Chamber takes into account Report No. 062-2015-SUNAT/5D0000, by which SUNAT establishes that the distributor that receives goods to be delivered as prizes to retailers, must not recognize the amount of such goods as tax income, since it does not represent an economic benefit for him.

Suspension of the audit (Cassation No. 3704-2018, Piura).- The Constitutional and Social Law Chamber of the Supreme Court establishes that the suspension of the audit is only effective if it is communicated by the Tax Administration to the taxpayer by means of a letter one month prior to the expiration of the term of the audit procedure.

Invalid Issuance of Securities (RTF No. 5860-8-2019).- In this case, SUNAT issued the determination and fine resolutions on the same day that the result of the requirement supporting them was notified. The Tax Court stated that since the securities were issued in advance of the administrative act that supports them, there was a cause of nullity.